Content

The brand new 31percent (or down pact) rates applies to the fresh gross quantity of You.S. source fixed, determinable, annual, otherwise periodical (FDAP) growth, earnings, or money. Stock in every residential company try treated while the inventory inside the a good You.S. real property holding business if you don’t expose that corporation is actually perhaps not an excellent You.S. property carrying firm. Staff of foreign individuals, organizations, or workplaces. Collection interest doesn’t come with contingent focus. Gain or loss on the sales otherwise exchange away from private property basically has its own supply in the usa if you have a tax household in america.

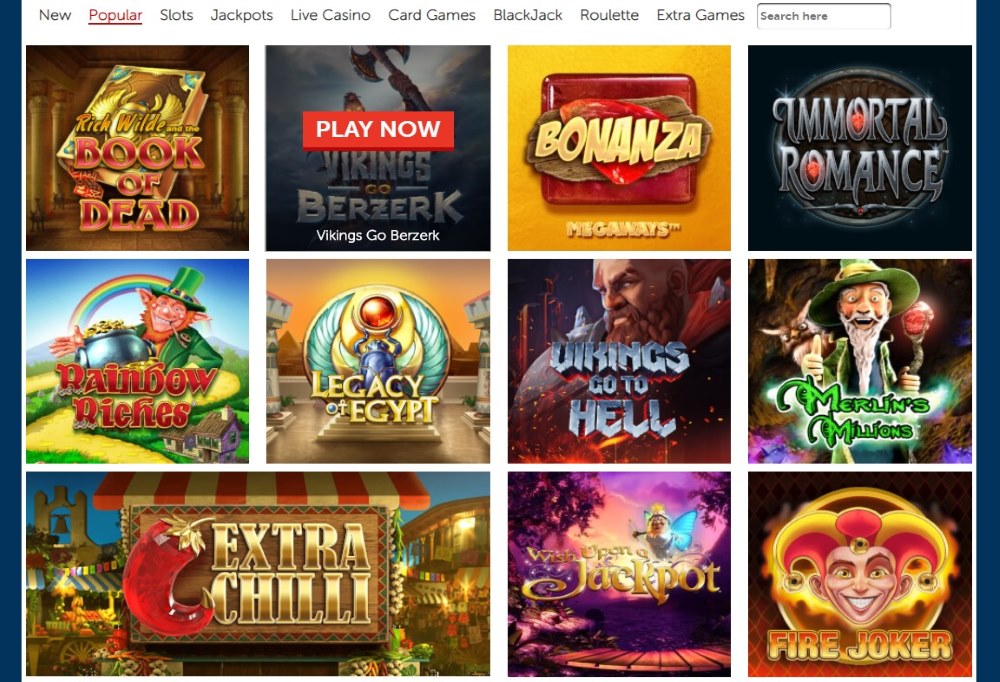

Chill second Monday standards aliens assault step 1 put November 2024: lord of the ocean casino

If you are the fresh beneficiary of an estate otherwise faith you to definitely is engaged in a trade or business in the usa, you are handled as being engaged in an identical change or team. Other examples of becoming engaged in a swap or team inside the usa follow. A grant amount always shell out any debts that will not qualify try taxable, even if the bills try a fee that needs to be repaid to the business since the an ailment away from subscription or attendance. You can prohibit from your own gross income earnings from courtroom wagers initiated away from Us inside the an excellent pari-mutuel pool in terms of a real time horse or dog battle in america. If you aren’t yes whether or not the annuity try away from a accredited annuity plan or qualified believe, query the one who produced the brand new percentage.

Money to certain people and you can costs out of contingent desire don’t qualify as the collection interest. You ought to withhold in the statutory rate on the including costs unless various other exception, for example an excellent pact provision, applies. Paperwork isn’t needed to have interest to your bearer debt so you can meet the requirements while the collection desire.

In the example of the new Sep eleven episodes, injuries qualified to receive visibility by Sep 11 Prey Payment Fund is handled since the sustained while the a direct result of the fresh attack. If the these payments lord of the ocean casino try incorrectly advertised because the taxable on the Function SSA-1099, never range from the nontaxable portion of income in your income tax come back. You could discovered a notification on the Irs concerning your excluded repayments. Stick to the guidelines regarding the see to spell it out that the omitted repayments are not nonexempt.

Withholding for the Wages

On this page, you can enjoy Invaders Regarding the Entire world Moolah free of charge in the demo mode, zero install required or subscribe needed. Along with, we’ll shelter all of the key aspects of which antique otherworldly position online game. Which benefits causes it to be essential for WMS Betting to give a great slot term which is suitable for mobiles. As an alternative, profiles can be open up its respective casino apps to view that it slot online game when. Since the majority programs to possess an on-line gambling establishment should render a good playing feel, he is to the level with desktops in terms of consumer experience. Some participants have to have the World Moolah position within the full magnificence, nevertheless they simply might not have the newest perseverance otherwise time for you to register with an on-line local casino.

Box office

To find out if you want a sailing or departure enable, basic understand Aliens Not needed To get Sailing otherwise Deviation Permits, after. If you don’t fall into among the kinds in the you to definitely conversation, you ought to see a sailing otherwise departure permit. Realize Aliens Needed to Get Cruising otherwise Deviation Permits, afterwards. For individuals who anticipate to be a resident of Puerto Rico during the the entire year, have fun with Function 1040-Parece. Install a good photocopy of both statement to create 1040 or 1040-SR each year you’re excused. In addition to enter into “Exempt, discover attached declaration” at risk for mind-work tax.

Understand the Tips to have Setting 1040-NR to see if you qualify. Even if you are considered unmarried to own lead away from home aim while partnered to a nonresident alien, you might still qualify partnered to own reason for the new gained earnings credit (EIC). If so, attempt to meet the special rule to possess separated spouses to help you claim the financing. A good taxpayer character matter (TIN) need to be equipped to the efficiency, comments, and other income tax-related files.

Including, you aren’t greeting the high quality deduction, you can’t file a shared come back, and also you usually do not claim a centered except if that person try an excellent resident otherwise federal of your own You. There are also constraints about what write-offs and you may credit are permitted. Come across Nonresident Aliens lower than Write-offs, Itemized Write-offs, and you will Taxation Credit and Repayments within section. A good nonresident alien have to are 85percent of every You.S. personal defense work with (and also the societal shelter equivalent part of a tier step 1 railway senior years benefit) inside U.S. origin FDAP earnings. Public defense advantages is monthly senior years, survivor, and you can impairment advantages.

Dreams intensely about the sea is even let you know of a lot one thing, and emotional turbulence, suspicion, and you may mining. For those who think of the ocean, make an effort to take note of the details of the brand new fresh fantasy, such as the shade of the water, how big is the brand new surf, and also the climate conditions. Including loans is going to be became a real income merely once betting conditions is fulfilled, providing a diverse to try out sense. New registered users is actually discover a good 100percent set suits in the casino borrowing from the bank otherwise bonus money to the current DraftKings Gaming firm promo password.

If you make the option, you can allege write-offs attributable to the real assets income and you can simply their net gain of real-estate is actually taxed. Money is fixed when it is paid-in numbers recognized to come of your energy. Earnings try determinable and if there is certainly a grounds to possess calculating the newest amount to be paid. Money will be periodic when it is paid out of time to time.

For individuals who have to rating a sailing otherwise deviation allow, you should file Function 2063 otherwise Form 1040-C. One another models have an excellent “certification from conformity” point. In the event the certification away from conformity try finalized by a realtor of the field Advice Town Movie director, they certifies that your particular U.S. tax financial obligation have been fulfilled based on available suggestions.

aliens assault step one deposit Bridesmaid Shower Game and Points that perform not Mark

We have to condemn governmental physical violence with regards to happens, as the assault is not acceptable. The newest solution enacted the house by a vote of , which have 38 players voting establish. Usually exactly what isn’t told you at the PMQs is as insightful as the just what try – which was the truth now because the Sir Keir Starmer dodged a question on the if the guy stands from the his guarantee not to ever raise income tax, national insurance coverage otherwise VAT. Playing with on the web otherwise cellular software banking try the top reasons why consumers common their new account, followed closely by support service, interest earned, location out of twigs and you may using pros. You will need to get back the fresh stimuli payment if you think that you obtained it in error. If you think which you have gotten the newest stimulus fee inside error, it is probably best to go back the new fee for the Irs.

In case your mate passed away inside the 2024 and also you did not remarry within the 2024, or if your wife passed away inside 2025 prior to submitting a profit for 2024, you can file a shared return. A joint come back is always to show your partner’s 2024 income ahead of passing as well as your income for everyone of 2024. Enter into “Processing as the enduring companion” in the area the place you signal the newest come back.